Top Canadian ETFs to Buy

Canada is home to so many unique and profitable companies that it can be difficult to research all of them and invest accordingly. That's why instead of trying to individually select the best stocks, you might be better off investing in ETFs instead.

ETFs (short for Exchange Traded Funds) are like baskets of a bunch of different stocks that usually have a common objective and are managed by a professional fund manager. The key benefits to holding ETFs over stocks is that they are much less volatile since they are a combination of a bunch of stocks and in an economy like Canada which is known for its stable and reliable growth, an ETF can take some of the guesswork out of portfolio construction since most broad industry sectors usually do well.

Below, we will list some of our favorite ETFs in Canada, why they are our favorite and break down some of the most important things to know before investing.

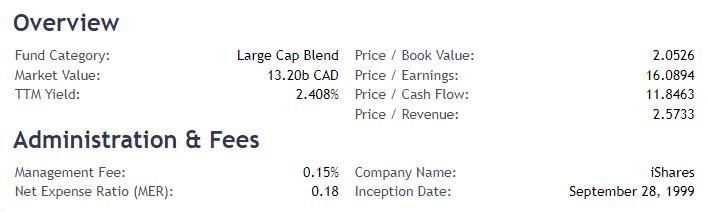

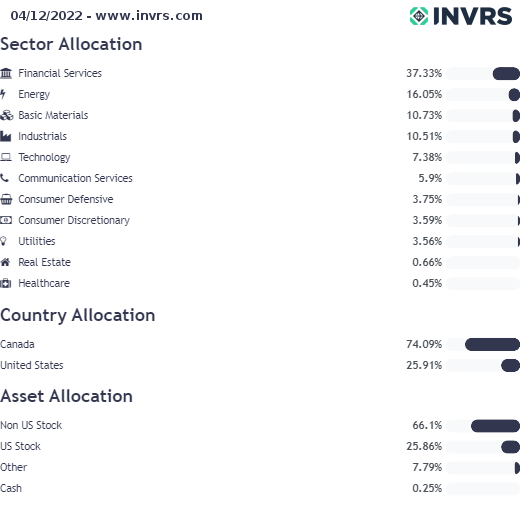

iShares S&P/TSX 60 Index ETF, Ticker: $XIU

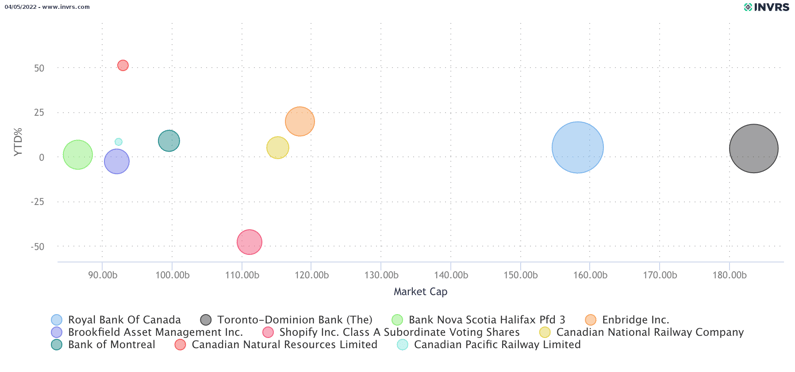

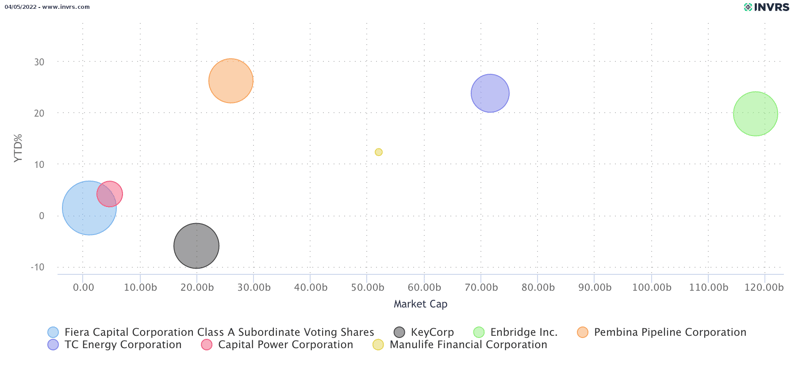

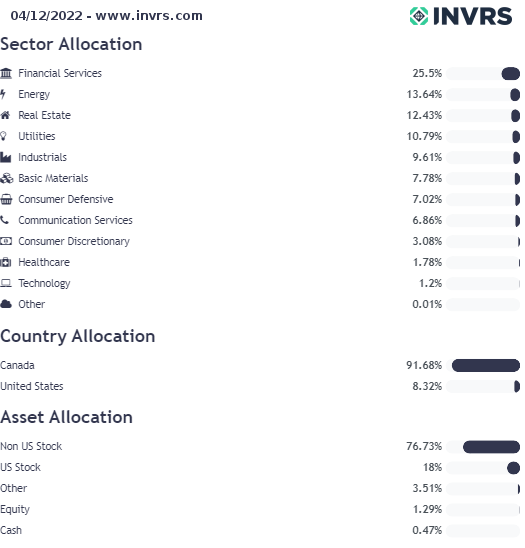

The $XIU ETF is one of the most popular amongst Canadian investors. It includes 60 of Canada's largest and most established companies including RBC $RY, Shopify $SHOP, Enbridge $ENB and many more.

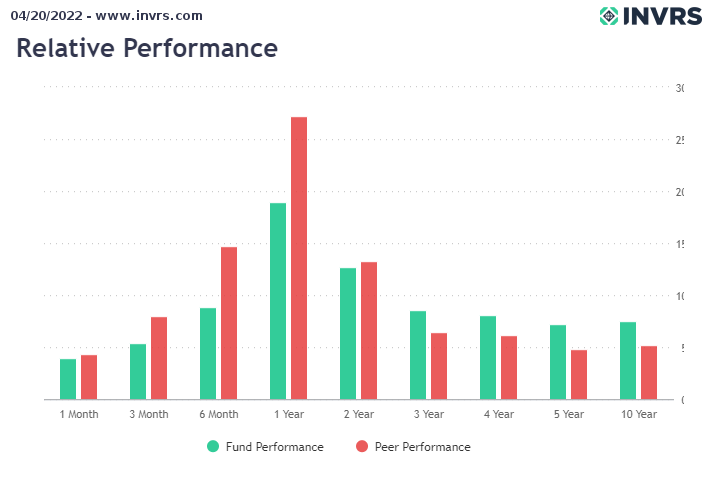

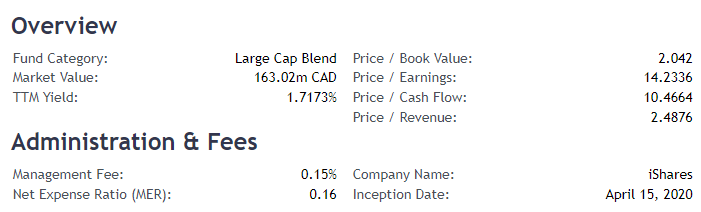

This ETF is great for getting broad exposure to all of the companies that truly drive and support the Canadian economy. With a dividend yield of 2.34% and a management expense ratio of only 0.18%, this is a great ETF with low risk and a high potential for gains.

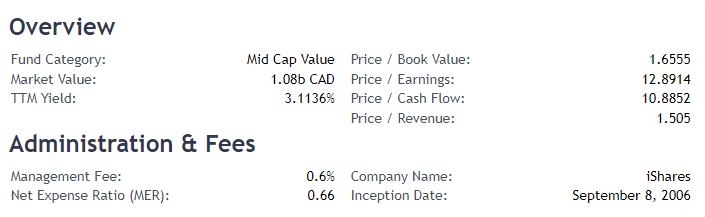

iShares S&P TSX CDN Dividend ETF, Ticker: $CDZ

Canada is known for having some of the best dividend stocks around and this ETF aims to take advantage of that. The CDZ ETF is purely made up of Canadian dividend aristocrats. You may be asking yourself “What is a dividend aristocrat?”. A dividend aristocrat is any company that have raised their dividends consecutively for the past 25 years. With a current dividend yield of 3.12%, this ETF is great for those who want a consistent growing cash flow in their portfolio.

CDZ also gives its holders access to the above stocks as their top 10 holdings which has led to the gains found below. Overall this is a great pick for anyone who likes being invested in stable companies with growing dividends and a management expense ratio of only 0.66%.

All the graphs/information discussed in this post were pulled from INVRS in minutes, for free. INVRS is like Yahoo Finance on steroids, and comes with social/collaborative features to work together with other investors. Fill out the form below to get access to the beta of INVRS.

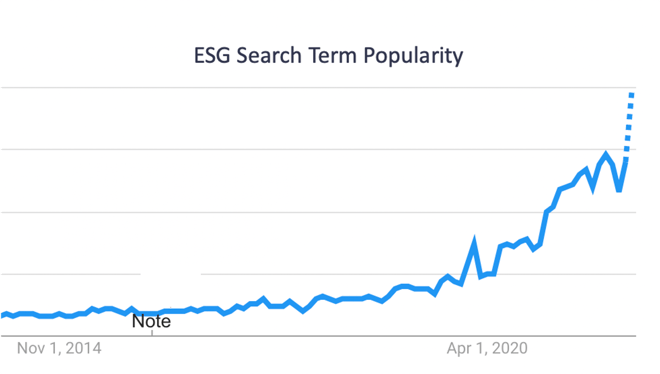

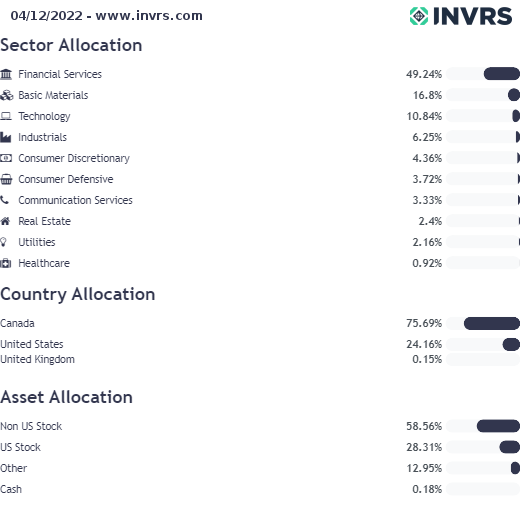

iShares ESG Advanced MSCI Canada Index ETF, Ticker: $XCSR

One of the most popular trends in the financial space right now is sustainability and environmental, social and governance (ESG) principles. The XCSR fund was created after recognizing the demand and necessity to make ESG friendly stocks available to the public.

The XCSR fund seeks to significantly reduce exposure to the production of fossil fuels and other industries with elevated sustainability risks and provide a low-cost sustainable investing building block for the core of your portfolio.

Covered Call Canadian Banks ETF, Ticker: $ZWB

This ETF is quite different from the past ones we've already shared on this list. ZWB has been designed to provide exposure to a portfolio of Canadian banks while earning call option premiums. They do this by investing in securities of Canadian banks, and dynamically writing covered call options which are written out of the money and selected based on analyzing the option's implied volatility. This fund is great for people looking for exposure in Canadian banks while also aiming to achieve higher income from equity portfolios.

While this fund does have the highest management expense ratio on this list at 0.72%, it is justified by the greater requirements needed to adhere to this fund's strategy as well as its high dividend yield at 5.6% currently. This fund is quite unique as it's only made up of companies (those 6 being the largest Canadian banks).

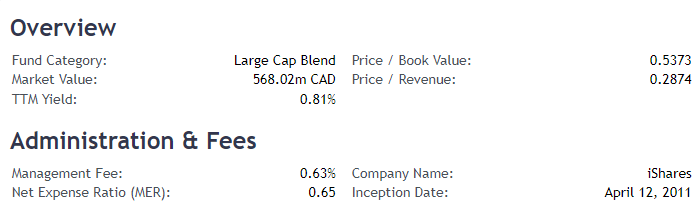

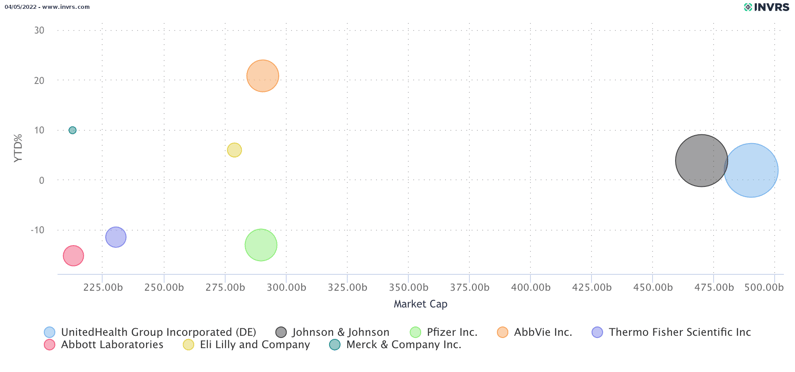

iShares Global Healthcare Index ETF, Ticker: $XHC

The healthcare industry can be very difficult to invest in since usually, most healthcare company's business models are based on the formulation of new drugs and vaccines to cure diseases. Unfortunately, this can make healthcare companies difficult to invest in since there are so many companies out there and it is impossible to tell with 100% accuracy whether or not a company will be approved by the FDA. That's why a healthcare ETF is the perfect addition to someone's portfolio who wants to gain exposure to that industry without reading through endless pages of medical jargon.

XHC is a Canadian hedged version of the popular U.S. ETF, $IXJ. IXJ has 135 different holdings including blue-chip companies like UnitedHealth $UNH and Johnson and Johnson $JNJ while also including a bunch of growth stocks early in development. For only a 0.65% expense ratio, this fund allows you to have exposure to some of the largest and fastest-growing healthcare companies on the market right now.

The reason you'd want to hold XHC (the Canadian hedged ETF) over $IXJ (the underlying ETF) is to eliminate currency exchange risk from potentially eating away at your potential gains.

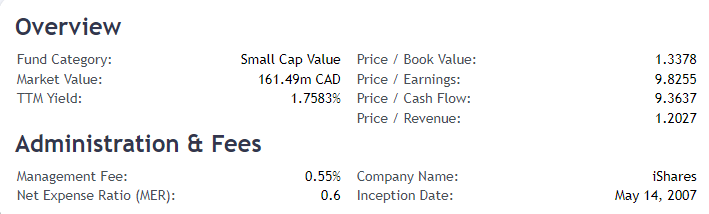

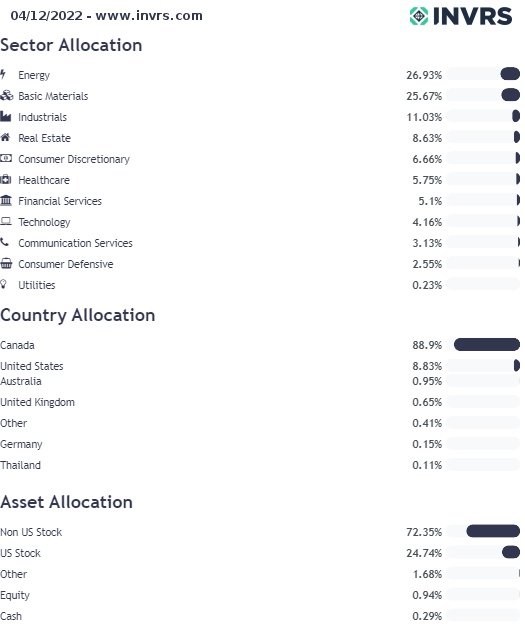

iShares S&P/TSX Small-Cap Index ETF, Ticker: $HCS

The final ETF we think you should check out is $XCS. While it may be easy to invest in all the blue-chip that have constant news and report coverage, it can be quite difficult to stay up to date on some of the smaller cap companies. That is where this ETF comes in handy. It has 235 total securities ranging from $4B in market cap to only $100M. This is by far the riskiest ETF on this list but it also has the highest potential for gains.

Conclusion

These are just a couple of the best ETFs covering the Canadian market. What makes these ETFs so good is their ability to cover an area of the market that would be either too risky to invest in individual stocks or take too long to perform due diligence on the entire industry yourself while also not charging too much in management expense ratios.

Sources: BMO, Blackrock, Vanguard, Sustainalytics, Google Trends, INVRS

This is not financial advice. Everything in this note is purely for educational and entertainment purposes.

To get a better look at your stocks/ETFs, check our INVRS. It's a free collaborative investment research platform with financial and price data on over 10,000+ North American Stocks/ETFs. All charts in this article were generated for free via INVRS.

.png?width=715&name=my-chart%20(8).png)